Creating co-benefits and commercial opportunities through suitable blended financing mechanisms.

Project activites: Investment landscape assessment, sustainable finance products assessment, working groups and roundtables, Blue Finance Product development, Nature-based Solutions (NbS) Accelerator creation, bankable NbS portfolio development.

The project aims to identify the most suitable financing mechanisms for climate and biodiversity and develop a roadmap to establish such systems to ultimately implement and test locally-developed bankable NbS projects in the selected site(s).

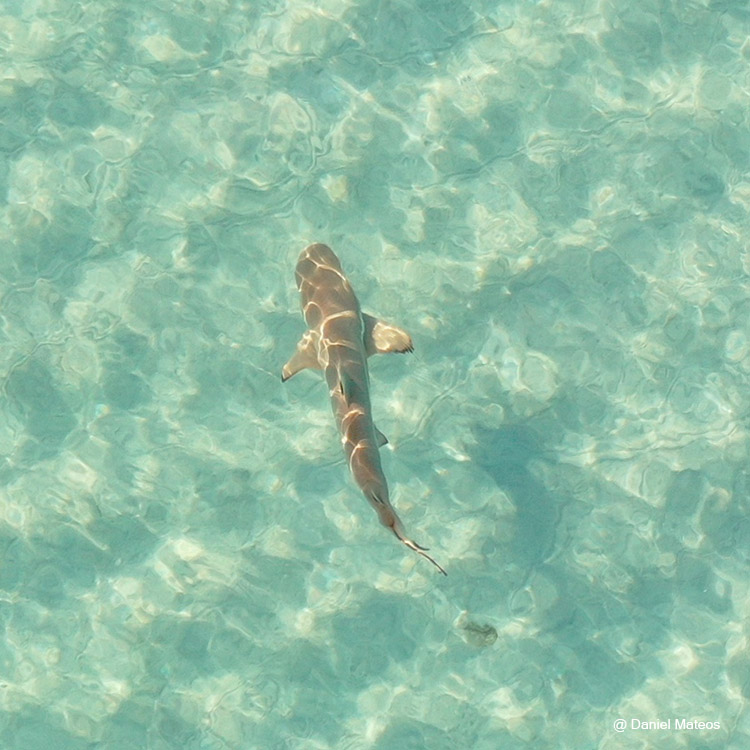

Rise of ecotourism in the UAE:

The NbS project aims to create a pipeline of low-impact ecotourism initiatives to promote sustainable business innovation and attract further investments for nature. As such, there are plans for an eco-trail at Mangrove Beach in Umm Al Quwain to raise public awareness, promote appreciation for the natural beauty of the area, and stimulate ecotourism.

Innovative Solutions to Improve Food Security:

We are studying the feasibility of enhancing, restoring and cultivating local salt-tolerant plants in coastal lagoons. These have the potential to be used in food production as super foods, green salt, fodder and other by-products which can be produced by local communities, in turn creating alternative revenue streams, sparking greater SME growth and entrepreneurship, and supporting economic diversification.

-

Identifying barriers and opportunities to unlock public/private finance for NbS;

-

Determinating Blue Carbon financing incentive options and helping establish a finance vehicle that enables blended finance towards NbS in the UAE: Blue Finance Product – first of its kind;

-

Creating an NbS projects portfolio based on climate mitigation, resilience and co-benefits which is worth investing in, ultimately helping increase financial flows towards nature conservation with tangible returns for potential investors.

-

Reviewing the current investment landscape in terms of financial flows and current sustainable finance products, while identifying barriers and opportunities for the uptake of NbS Solutions financing;

-

Identifying Blue Carbon financing incentive options and helping establish a finance vehicle that enables blended finance for NbS in the UAE;

-

Co-creating a portfolio of bankable projects in collaboration with home-grown start-ups and small and medium-sized enterprises (SMEs) to be implemented in the selected site(s), which could then be replicated elsewhere to increase environmental and financial gains;

-

Establishing Working Groups and roundtables to assess motivations for investments in NbS, make recommendations, test assumptions and advise on actions;

-

Raising additional grant and donor capital with support from the HSBC Global Accelerator programme, which will help incubate and structure investor-ready NbS, outlining their benefits, risks and trade-offs, as well as the likely return on investment.

-

Setting up partnerships with existing initiatives in the UAE and creating a UAE NbS Accelerator special initiative that will help spark interest towards impact investing while creating the necessary avenue to divert sustainable finance to new, NbS-driven business opportunities in the UAE.